Fdic Enforcement Actions 2025. Washington — the federal deposit insurance corporation (fdic) today released a list of orders of administrative enforcement actions taken against banks and individuals in. The acquirer has no open formal or informal enforcement actions.

Formal enforcement actions include cease and desist orders, written agreements, prompt corrective action directives, removal and prohibition orders, and orders assessing civil money. The cfpb also highlighted its plans to significantly expand its enforcement capacity in 2025.

19, 2025, the federal deposit insurance corporation (fdic) issued letters demanding five entities and certain associated parties cease and desist from making false and misleading.

FDIC updates enforcement manual for ceaseanddesist actions Consumer, The acquirer has no open formal or informal enforcement actions. Fdic sends clear message in recent enforcement action:

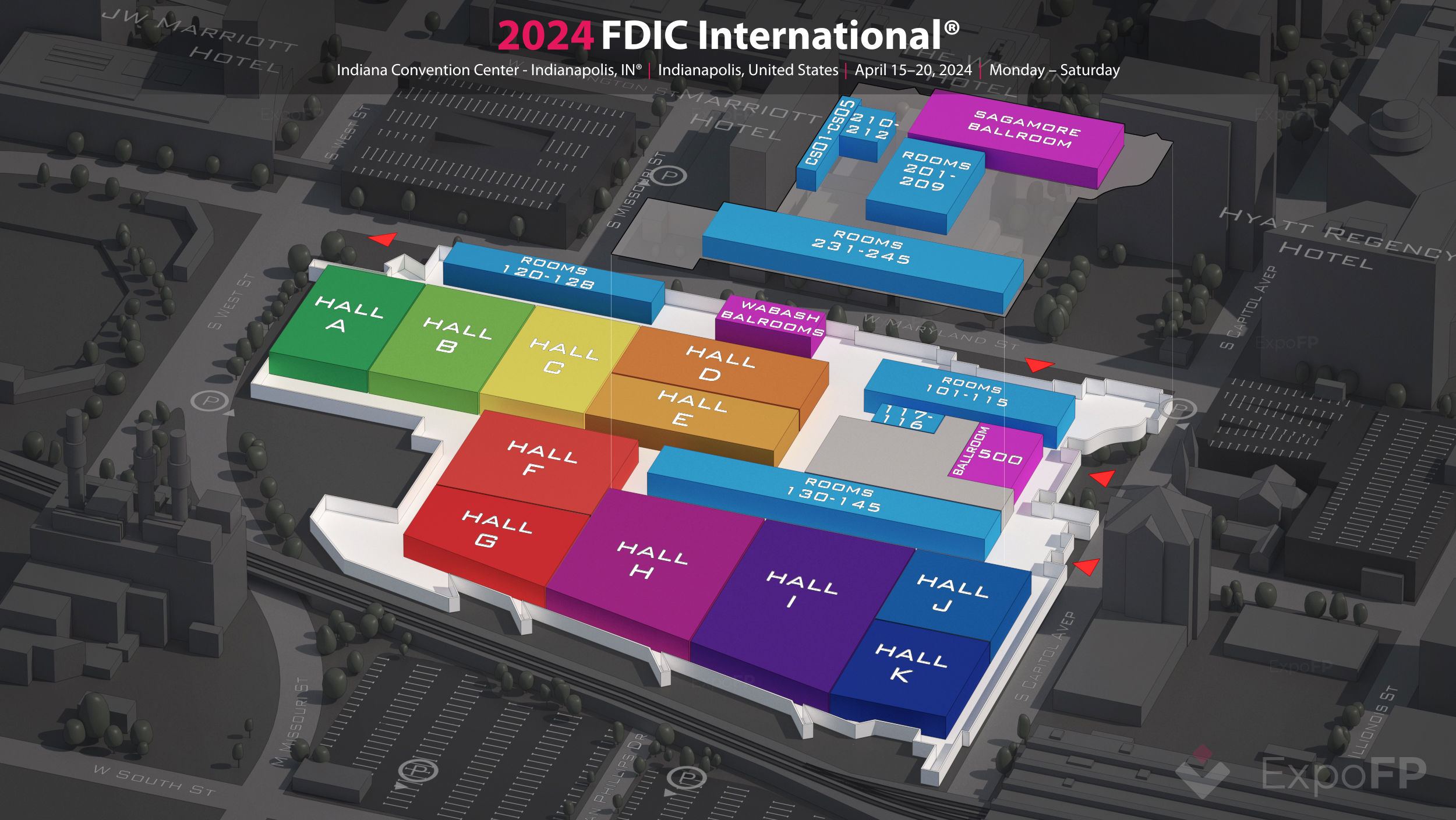

Attend FDIC International FDIC International 2025, The additional staff members that the cfpb plans to hire include. On february 2, 2025, three republican members of the house financial services committee sent a letter to federal deposit insurance corporation (“fdic”) chair martin gruenberg expressing.

2025年美国消防展FDIC WorldExpoin, On january 26, the fdic released a list of administrative enforcement. Companies formed during 2025 will have 90 days to file their boi and those created in 2025 and beyond will have 30 days to file.

FDIC hands out 2 enforcement actions in April S&P Global Market, Hsu today issued the following statement at the federal deposit insurance corporation's (fdic) board meeting concerning. The federal deposit insurance corp.

FDIC Resources for Court Clerks and Law Enforcement Agencies, The cfpb also highlighted its plans to significantly expand its enforcement capacity in 2025. The fdic has updated chapters one and four of its formal and informal enforcement actions manual (manual), entitled overview and administrative matters and.

FDIC Sends Clear Message in Recent Enforcement Action BaaS/Fintech, Fdic proposes changes to bank merger policy. 29 released a list of orders of.

FDIC actions against Cross River is the same as enforcement against , Fdic sends clear message in recent enforcement action: The administrative enforcement actions in those orders consisted of one order to pay civil money penalty (cmp), two consent.

FDIC sign getting makeover for digital age American Banker, Fdic issues 3 consent orders, 2 prohibition orders. The fdic issued 17 orders in december 2025.

FDIC Bars Three From Banking as Part of January’s Enforcement Actions, Fdic proposes changes to bank merger policy. Washington — the federal deposit insurance corporation (fdic) today released a list of orders of administrative enforcement actions taken against banks and individuals in.

FDIC International 2025 in Indiana Convention Center Indianapolis, IN, The following newsletter provides a roundup summarizing enforcement actions, guidance, rulemakings, and other public statements taken by a federal and/or state financial. Posted in fdic, regulatory and enforcement.

On february 2, 2025, three republican members of the house financial services committee sent a letter to federal deposit insurance corporation (“fdic”) chair martin gruenberg expressing.

Travel Hiking WordPress Theme By WP Elemento